Union Budget 2024-25: A Missed Opportunity for Learning and Welfare

| Aspect | Details |

|---|---|

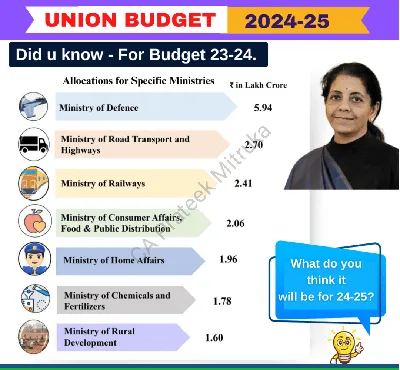

| Budget Presented By | Finance Minister Nirmala Sitharaman |

| Occasion | Union Budget 2024-25 |

| Government | Bharatiya Janata Party (BJP)-led coalition government, third term |

| Economic Vision | Focus on "Viksit Bharat 2047" with emphasis on private sector-led economic growth |

| Employment Initiatives | 1. Employment subsidies: ₹15,000 in three installments for new employees earning up to ₹1 lakh/month. 2. Government contributes ₹3,000/month for two years towards PF. 3. Skilling schemes, tax concessions for foreign firms. |

| Agriculture Initiatives | 1. Long-term program to raise productivity and production.2. Does not address demands for legally guaranteed Minimum Support Price (MSP). |

| NDA Disappointments | Lack of significant financial support for welfare schemes. JD(U) in Bihar and TDP in Andhra Pradesh denied promised financial backing. |

| Ignored Welfare Schemes | 1. National Social Assistance Programme: Allocation unchanged from 2023-24. 2. National Rural Employment Guarantee Programme: Allocation unchanged from 2023-24. |

| Fiscal Consolidation | Fiscal deficit projected to reduce from 4.9% of GDP in 2023-24 to 4.5% in 2024-25. |

| Capital Expenditure | Increased from ₹7,40,025 crore (2022-23) to ₹9,48,506 crore (2023-24), and further to ₹11,11,111 crore (2024-25). |

| Revenue Sources | Dependence on dividends and surpluses from Reserve Bank of India (RBI) and public financial institutions. |