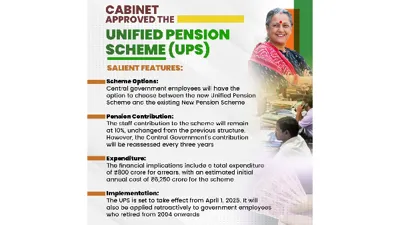

Unified Pension Scheme (UPS) Under National Pension System (NPS) - Key Features and Benefits

| Aspect | Details |

|---|---|

| Effective Date | April 1, 2025 |

| Applicability | Government employees joining on or after January 1, 2004, or after April 1, 2025. State governments can opt voluntarily. |

| Key Benefits | Assured pension, family pension, minimum pension, inflation indexation, lump-sum payment, gratuity. |

| Government Contribution | Increased from 14% to 18.5% of basic pay + DA. Employee contribution remains at 10%. |

| Eligibility | Minimum 10 years of qualifying service for superannuation; 25 years for voluntary retirement. |

| Assured Payout | 50% of average basic pay of last 12 months; minimum ₹10,000/month for 10+ years of service. |

| Family Payout | 60% of last payout to spouse; Dearness Relief applicable. |

| Lump-Sum Payment | 10% of monthly emoluments for every 6 months of service at superannuation. |

| Investment Structure | Divided into Individual Pension Fund (employee + matching govt. contributions) and Separate Pool Corpus (additional 8.5% govt. contribution). |

| Implementation | Minimum assured payout for 10+ years of service; Dearness Relief starts with payouts. |