NPS Vatsalya Scheme: A New Initiative for Children's Future Savings

| Aspect | Details |

|---|---|

| Launch Date | Officially launched by Union Finance Minister Nirmala Sitharaman. |

| Scheme Type | Extension of the existing National Pension Scheme (NPS). |

| Managed By | Pension Fund Regulatory and Development Authority (PFRDA). |

| Target Audience | Children; parents can save for their child's retirement fund. |

| Investment Focus | Market-linked securities like equities and bonds. |

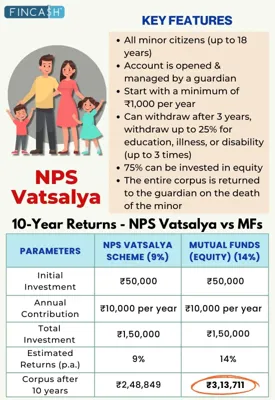

| Minimum Contribution | Rs. 1,000 per year. |

| Key Feature | Allows parents to start saving for their child's retirement from infancy. |

| Partial Withdrawal | Allowed after 3 years; up to 25% of the corpus for specific purposes. |

| Full Withdrawal Age | At 18 years; up to Rs. 2.5 lakh can be withdrawn, 20% if it exceeds. |

| Death of Subscriber | Entire corpus given to nominee/guardian; legal guardian can manage account. |

| NPS Launch Date | 1st January 2004 (initially for government recruits, extended to all citizens from 1st May 2009). |