| Category | Details |

|---|---|

| Event | Reserve Bank of India (RBI) imposes penalties on three cooperative banks |

| Date | November 6, 2025 |

| Context | Co-op Kumbh 2025 conference held in New Delhi |

| Purpose | Reinforce regulatory vigilance and compliance in cooperative banking sector |

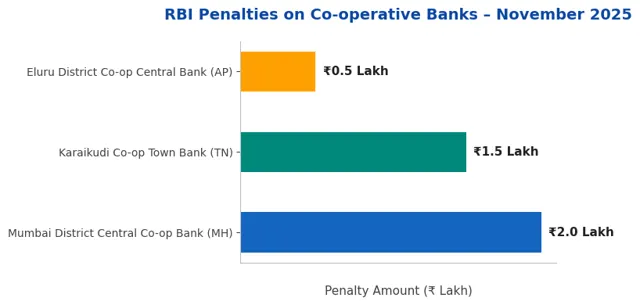

| Penalized Banks | 1. Mumbai District Central Co-op Bank Ltd. (Maharashtra) - ₹2 lakh |

| 2. Karaikudi Co-op Town Bank Ltd. (Tamil Nadu) - ₹1.5 lakh | |

| 3. Eluru District Co-op Central Bank Ltd. (Andhra Pradesh) - ₹50,000 | |

| Violations | 1. Section 20 of Banking Regulation Act, 1949 - Lending to directors |

| 2. Prudential Norms on Capital Adequacy | |

| 3. KYC Guidelines | |

| Key Legal Provisions | Sections 20, 47A(1)(c), 46(4)(i), 56 of Banking Regulation Act, 1949 |

| Significance | Highlights importance of compliance, capital adequacy, and KYC norms |

| Impact | Encourages transparency and prevents financial crimes |

Contact Counsellor