RBI Announces Fortnightly Credit Reporting: What It Means for Borrowers and Lenders

| Aspect | Details |

|---|---|

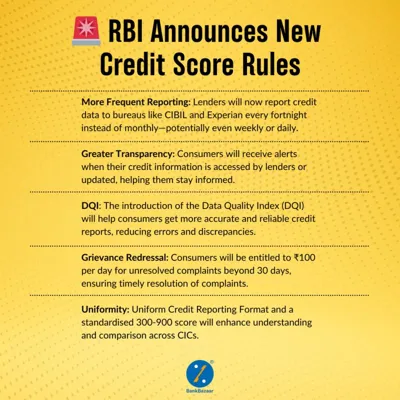

| Announcement | RBI changes credit information reporting frequency from monthly to every 15 days. |

| Effective Date | Immediate |

| Key Objectives | 1. Faster updates for borrowers. |

| 2. Enhanced accuracy of credit reports. | |

| 3. Better risk assessment for lenders. | |

| Impact on Borrowers | Changes in credit status (e.g., loan repayments) will reflect more promptly. |

| Impact on Lenders | Improved risk assessment, leading to more informed lending decisions. |

| RBI Governor's Statement | Shaktikanta Das stated this would enhance transparency and promote a healthier credit culture. |

| Expert Reactions | 1. Vishal Sharma (AdvaRisk CEO): Praised the move as progressive. |

| 2. Anil Gupta (ICRA Ltd.): Noted quicker updates will improve lending decisions. |