RBI Financial Inclusion Index (FI-Index)

What is the FI-Index?

| Feature | Details |

|---|---|

| Launched by | Reserve Bank of India (RBI) |

| First Published | 2021 |

| Frequency | Annually in July |

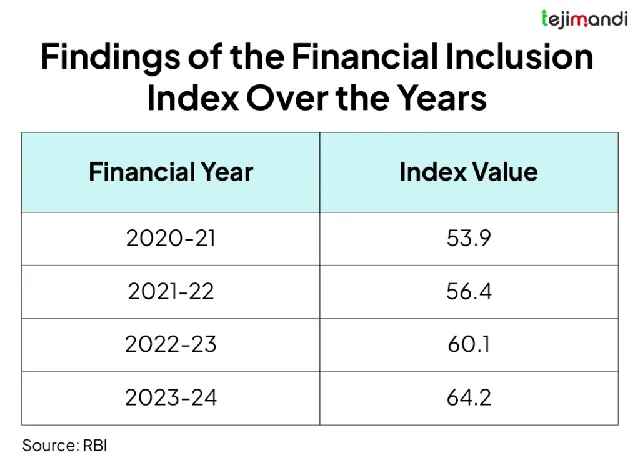

| Latest Value (FY25) | 67.0 (↑ from 64.2 in FY24) |

| Index Range | 0 to 100 (0 = full exclusion; 100 = full inclusion) |

| Objective | Measures the degree of financial inclusion across India |

| Base Year | No base year used |

Key Components of FI-Index

| Parameter | Weight (%) | Description |

|---|---|---|

| Access | 35% | Availability of banking/investment/insurance services (branches, ATMs, etc.) |

| Usage | 45% | Actual usage of services – accounts, loans, remittances, savings |

| Quality | 20% | Financial literacy, grievance redressal, transparency, digital awareness |

What’s New in FY25?

-

FI-Index improved from 64.2 to 67.0.

-

Attributed to:

Increased usage of digital payments & insurance Better financial literacy Improved service quality and outreach

Sectors Covered

| Sector Included |

|---|

| Banking (commercial + rural) |

| Insurance (life + general) |

| Investment services |

| Postal financial services |

| Pension (e.g., NPS, Atal Pension Yojana) |